Choosing the right banking solution

Choosing the right banking solution can be tough. I've tried several and chose Found. It provides the solutions I need to invoice my clients domestic and international and pay my taxes.

TECHNOLOGY CHOICES

Mike Conley

3/26/20247 min read

Who am I?

That is a brilliant question, because it should help you determine if you care what I have to say. I'm a small business owner who has multiple LLCs. One of the LLC's is for my Fractional CTO consulting services for domestic and off-shores companies under the FractionalAdvantage.com name. Another LLC I use for marketing my SciFi and Fantasy books under the miketconley.com name.

For both these entities, I need a banking solution that can help send invoices, track payments and expenses, and help me with my taxes. Over the years, I have employed multiple products that cost a lot, were not as simple as suggested, and didn't really help all that much for taxes.

It was in 2023 that I was reading a blog and saw something a about Found Business Banking solution. I was using a different online bank, and it was tax time. The process was a pain in the backside and that prompted me to look for a better solution. I'm happy I did, as I found the Found banking solution.

Customer Service Matters

I want to share this story before I get into the details of Found Business Banking solution. This event was a couple of months prior to writing this review. At the time, I had used Found invoicing for several months.

I identified a bug in the system. The bug isn't all that important. What is, is how they handed it.

On a Friday evening, I reported a bug in sending out reminder emails after an invoice was paid, but before it posts (stripe backend takes many days to post).

Monday I got confirmation of the bug report.

Tuesday, customer success reached out and thanked me for finding the issue and filing the bug report.

Wednesday, I was told the bug has been confirmed, and a solution is actively in development and they will release a fix that weekend.

This is what excellent customer support looks like. As someone who has over 30 years of software engineering and engineering leadership, I know not all bugs they get will get fixed this fast. The speed was impressive. But equally impressive was the communication, and that is what stands out to me.

What is Found Business Banking solution?

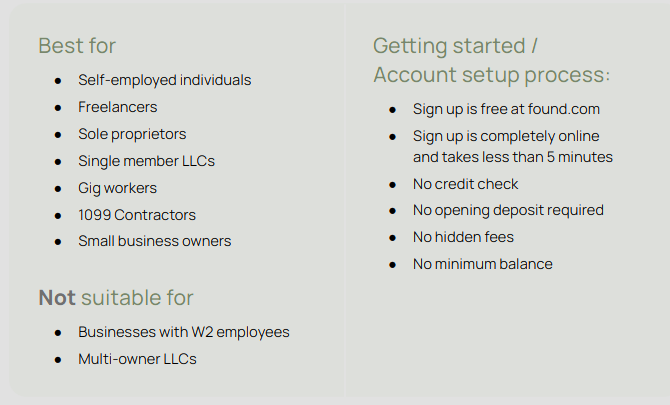

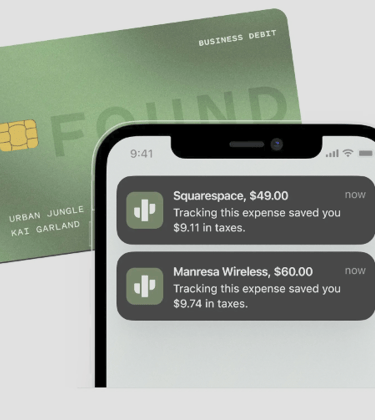

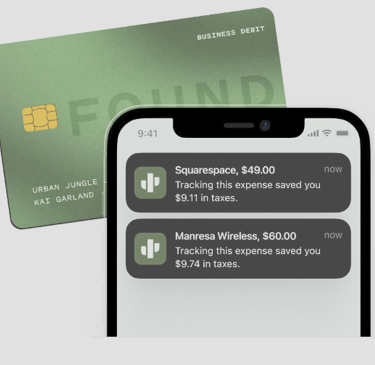

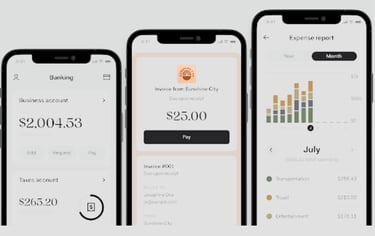

Launched in 2019, Found Business Banking is an all-in-one banking solution for freelancers, the self-employed, and solopreneurs to carry out their business banking, keep track of their bookkeeping, and financial tools to manage their expenses through a single platform. As well as providing you with a Mastercard debit card for business spending, the company offers tax and invoicing tools, such as automatic invoice generation and the ability to pay taxes via the app (as a Schedule C filer as part of the Plus plan).

Found business banking review

Pros

Cons

Free to sing up for an account

No required fees

Great Customer service

Good mobile support

Great security

Free virtual Debit Cards

Free physical Debit Cards

Bookkeeping

Calculates taxes with write-offs tracking

Automated tax saving

Manage 1099 contractors

Auto generated tax forms

Free account does not earn interest (however Plus account does)

Getting paid via credit card takes a few days

Does not accurately describe the cost of taking credit card payments from foreign sources.

At a glance...

You've held on this far, so let's dig a little deeper.

Overall Score - 9

Out of 10

Banking Services

9.5

It's 2024 and by now the whole online bank things is pretty well figured out. However, Found Business Banking solution takes it a little further with their easy-to-use website and app. They come equipped with expense tracking, automatic tax savings, and so much more. And with no monthly maintenance fees, no hidden fees, and no minimum deposit.

The no hidden fees mean a lot to me. As does the no minimum deposit or balance. The way I'm using Found Business Banking solution for my LLC, I issue invoices to my clients world-wide. Then they use one of the various methods to pay me. Once the money lands in Found, I have the taxes held out automatically and I hold any money I know I want to use for the business. The remaining balance I transfer to my a credit union my that my wife and use for household needs. Found Business Banking solution has made doing bank transferring easy to perform and this process works for my need.

There is one thing to note, in the free Found Business Banking account you do not earn interest. For me, that is fine as I transfer the money. However, if you keep large amounts in your business banking account, the Plus plan earns 1.5% APY up to $20K balance.

What I also enjoy is the flexibility to have multiple virtual Debit Cards. You get a physical card, but for some purchases online or associated with a virtual wallet, you can use virtual cards and take tracking your spending to a new level.

Bookkeeping

8.5

Previously, I used some bookkeeping programs that were named like they were for solopreneurs, but were built like you ruled a nation. It doesn't need to be that complex.

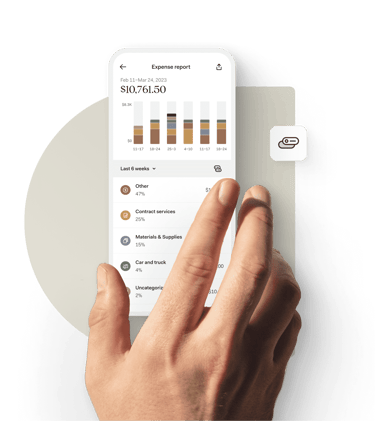

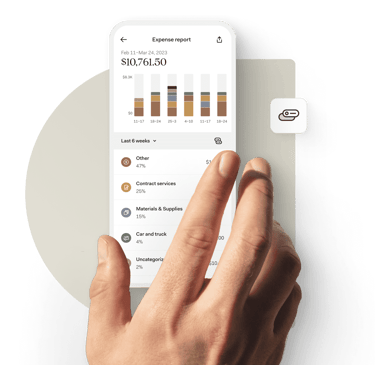

Found Business Banking solution makes it simple to track my income and expenses. It boasts the ability to automate expense tracking, has receipt capture and you can build custom rules, categories and tags. However, there is a limit to how much you can customize in the free version. The plus version takes off most of the limits.

A big piece of banking for is the ability to invoice your customers and make it easy for them to pay directly from the invoice. Found lets you customize invoices with your own custom branding and lets you control the information shown on the invoice. For the most part, the invoicing is great. There are just a couple of small things that would make it better. And the nice thing is I've submitted the requests, and it's on their backlog. They are passionate about helping the process work for their customer base and take requests seriously from users.

Taxes... Got to hate them, but got to do them

8.5

I used to spend a lot of money on products to track expenses only to have to fix what imports to tax systems and hope for the best.

Found Business Banking solution has made all that super easy. When money comes in from an invoice or anything you mark as a payment, the taxes get calculated on the fly in real-time. When you initially setup or within a few clicks later, you can set up auto saving for taxes into a Tax bucket. And anything that is classified as a write-off is part of the calculation. When tax time comes around, it will auto-generate tax form for you.

There is something I really like that is only available for the plus membership. That is In-app quarterly federal tax payments for all schedule C filers. That is a slick feature. I wish they could do my state ones too. It is absolutely possible to use the auto-generated reports and then go to the IRS and make a payment. But when time is money, I love the connivance of doing it in Found Business Banking.

The Key Tax Features are:

Integrated income tracking

Auto Saving for 1099 taxes

Maximize deductions with built-in expense tracking

Receipt capture and built-in substantiation guidance

Writeoff identification

Profit and loss, expense, and income reports

Auto-generated schedule-C

Annual tax filing packet

Live estimated tax bill

1099 sharing

It's one thing to have a great site, another to have a great mobile app.

10

By nature of what I do, I'm near a PC almost all the time. So I look for a good and easy-to-use website, and Found Business Banking solution does not disappoint. I find it easy and intuitive.

But many of the solopreneur out there are mobile warriors. For those of you that need more the mobile app delivers. The app allows depositing checks, and that is the way I use it. There is a process to authorize you to get this feature (the app tells you want to do) but once authorized, it's a straightforward process and you can choose if the check is Income or Funding.

Found is a financial technology company, not a bank. Business banking services are provided by Lead Bank, Member FDIC. The funds in your account are FDIC-insured up to $250,000 per depositor for each account ownership category. The Found Mastercard Business debit card is issued by Lead Bank pursuant to a license from Mastercard Inc. and may be used everywhere Mastercard debit cards are accepted.

Affiliate Links

Some links in this post are affiliate links. Specifically, affiliate links for Found Business Banking solution. This means if you click on the link, start a free account and fund it, I will receive an affiliate commission at no extra cost to you. All opinions remain my own and no fee or commission was provided for me stating my opinions.

Disclaimer

I completed this review by using actually using the Found Business Banking solution for my own LLCs for over six months and taking feedback from my wife who uses it for her 1099 work for nine months. The story about customer service is 100% legit.